To minimize investment risks, a project seeking investment must attract investors by being designed in such a way that it strikes a perfect balance between detail and comprehensibility.

This article explains:

1. The process of creating a project

2. The development of key performance indicators (KPIs)

3. Operational and strategic controlling

4. Why is a reasonable prediction of a stable return on investment so important for investors?

5. Conclusion

1. The process of creating a project

Introduction of the company and formulation of the project objectives

Before beginning contract negotiations, it is important to know that your business partner has a good reputation in the Ukrainian market. It should show what the company is all about and, above all, how its historical data and current activities can be used to build a partnership with favourable prospects. The partner should be evaluated by means of a smooth and transparent exchange of data, or should be evaluated as part of the due diligence process.

When developing a project, the first thing to remember is that a clearly formulated, pragmatic project description, the so-called theoretical part, which reflects the current situation. How the Ukrainian business partner intends to achieve their investment goals, through your investment, must be clearly outlined. The importance of the investment should be justified not only by financial indicators, but also by socio-economic and market-related ones that complement and underline the financial expectations of the project. The investor (you) should be given a complete picture of the project that is both specific and pragmatic.

Project structure

It is necessary to create a logical structure. This can vary from project to project depending on the investor's requirements but is generally quite rigid. Experience tells us that a well-founded and structured project attracts more, and more engaged, investors. At this stage, expert and experienced support is of vital importance. We offer our Ukrainian partners the following structure for an investment project (bi-engine.com), which is in accordance with the Agency for Economic Cooperation. A fully mapped project, according to all parameters, is a prerequisite for further cooperation.

A project can be summarized as follows:

-

Company Presentation

-

An Aim of the Project and Reasons For Implementation

-

A Project Description

-

Investment Volume

-

Planned Financing Structure

-

Profitability Analysis

-

Planned Involvement in the Project

-

Project Risks

-

Project Schedule

Finally, an investment project should create trust and give rise to more in-depth questions to organize further cooperation with potential partners. A convincing investment project model with the development of key performance indicators (KPIs) tailored to the needs of investors is the basis for successful investments.

After the potential investor has already developed an initial impression, the numerous variables must be checked, supplemented and defined accordingly.

Project promotion to potential investors and corporate partners.

No matter how promising a project may be, it cannot reach the target audience if it is not actively presented to those who would invest. There is a risk that a project will get lost amidst the crowd of other projects, because its unique qualities are difficult to convey. A convincing presentation of the project not only increases the number of interested parties, but is also the best source of information for making changes that meet the needs of investors. Mastering the investor's language improves clarity and understanding of the project. Most projects, especially investment projects, are revised and adapted in several iterations. They are reviewed by different stakeholders and decision makers who represent different interests and evaluate the investment from different perspectives. This is known as top-down project development. This step requires networking and is important because the critical evaluation by potential investors increases the quality, the level of detail of the project and the chances of its realization. If you have managed to finalize and structure your project plan, this step - presenting and refining the project according to the wishes of investors - is essential for the successful closing of a contract. The next section deals with the Key Performance Indicators (KPIs) that must be defined at the beginning of the project and reviewed as the project progresses.

2. The development of key performance indicators (KPIs)

Key performance indicators pave the way to success and are crucial for the ongoing measurement of the project’s performance. It is an intensive process that takes full account of the project objectives, stakeholder needs and available data. They are defined at the beginning of the project, customized to the investor's wishes and tracked until the project is completed.

Criteria for the development of performance indicators for project management:

- Use KPIs sparingly; additions should only be made when absolutely necessary.

- Pay attention to the level of aggregation: KPIs that are aggregated too much can obscure cause-and-effect relationships.

- Quality over quantity: This is the golden rule for KPIs, high-quality indicators will achieve far more than many low quality indicators.

- Reliability of data: The reliability of data, essentially ensuring that it produces actionable and reliable insights, is crucial for the correct calculation of key indicators.

- Use of regularly available data: Using regularly available data increases transparency with minimal effort.

- Clear visualization: The key performance indicators require clear visualisation in order to derive concise statements.

- Targeted communication: You need to consistently meet the needs of the stakeholders you are working with, as well as skillful reading and interpretation of the KPIs.

- Basis for decision-making: A KPI system provides a solid basis for decision-making by providing a clear overview of project status and performance.

The trick is to identify those KPIs that are not only relevant but also most accurately and concisely reflect the overall success of the project. In this context, selected KPIs for different areas (performance, financial, schedule, etc.) are presented below. They are intended to provide a clear picture of project progress and serve as a basis for informed investment decisions.

Important KPIs for project management

- KPIs cover various aspects of a project, e.g. time, cost, quality and productivity, as well as the monitoring of project progress. They serve as a benchmark for tracking progress against timelines, budget, quality standards or performance targets.

- Project costs and comparison of planned and actual costs. All planned costs are determined or recorded at the start of the project and assessed against the actual costs during the project. The comparison of target and actual costs makes cost deviations visible.

- Planning is crucial. Well-planned milestones and schedules help to maintain an overview of the project’s status. The implementation effort quantifies progress, and monitoring deviations from the project plan provides detailed information for optimization.

- Quality of work results and team productivity. The risk of disagreements and differences of opinion is particularly high in global projects or projects with foreign investors. Allowed to get out of hand, this can have a sizeable negative impact on financial risks, results and project quality. Good coordination and harmonization of the project, taking into account intercultural competencies, has a huge positive impact on the quality of key performance indicators.

- Measuring progress at operational level. In agile project management, various methods are used to measure progress, such as the burndown chart, which visualizes the progress of completed tasks compared to the current situation. These visualizations allow the project team to quickly record progress and make adjustments if necessary. Agile methods enable adaptive project management based on continuous feedback and changing requirements.

Deadlines and quality indicators:

- Schedule performance index (SPI): measures the deviation between actual and planned project progress.

- Schedule variance (SV): measures the deviation of the actual project date from the planned date.

- Lead time: measures the time from order placement to receipt of the completed project, our project outcome.

- Defect rate: measures the proportion of defective elements within the context of the rest of the project.

- Requirements fulfillment rate: measures the extent to which project performance requirements are met.

Project progress indicators:

- Milestones: measures the completion of key project milestones or tasks.

- Burndown chart: visualizes the progress of the project in terms of remaining tasks and resources.

- Gantt chart: visualizes the project plan in the form of a timeline using bars.

In the next section, the financial and profitability indicators of a project will be covered; they are an integral part of operational and strategic controlling.

3. Operational and strategic controlling

Operational and strategic controlling are equally important. Operational controlling is based on the KPIs and financial KPIs partially described in the previous section. They give investors a much needed insight into the quality of a project. Particular attention is paid to the profitability of the project. Depending on which aspects of the project are important, there are different KPIs, the exact meaning and relevance of which can vary depending on the industry, company size and other specific circumstances. Below you will find a list of the most important profitability KPIs:

- Return on ivestment (ROI): Return on investment is a basic metric that indicates how much profit an investment brings in relative to the cost of the investment. A high ROI is a vital indicator of whether the project has long term feasibility towards profitability.

- Net present value (NPV): NPV is a metric that measures the present value of all expected future cash flows of a project, considering the time value of money in its calculations. A positive NPV is an important indicator, showing the projects ability to create additional value. We will come back to this in the next section.

- Internal rate of return (IRR): The internal rate of return is the average annual return that an investor can expect over the lifetime of the project. A high IRR indicates a high average annual return on the capital investment.

- Amortization period (payback period): The payback period indicates how long it takes for the initial investment to be repaid by the project’s cash flows. Investors often prefer projects with a short payback period, as this means that the invested capital flows back quicker.

- Cash flow (cash-in vs. cash-out): Cash flow is the amount of money flowing into or out of a project. The reliability of their forecasts is important for budgeting and liquidity.

- Growth indicators: Investors are often interested in metrics that measure the growth potential of a project, such as sales growth rate, customer growth rate, market share and expansion opportunities.

- Customer acquisition costs (CAC): Customer acquisition costs refer to the average cash cost per customer acquired. Investors want to ensure that these costs are proportionate to the lifetime of the customer and the expected revenue.

- Utilization rate (response rate): The expense ratio indicates how quickly a company utilizes its capital. Investors want to be sure that the level of expenditure is efficiently managed and that the company is not burning through its capital too quickly.

At the heart of strategic controlling is the identification and continuous review of opportunities, risks, strengths and weaknesses, which can be summarized as a SWOT analysis (strengths, weaknesses, opportunities, threats) derived from the analysis of the external environment (Market Analysis Environment Analysis & Reporting).

What is the relationship between operational and strategic controlling?

If investment/project costs are too high, then they will negatively impact both investor forecasts and eventually income. The profitability check is part of operational controlling. In order to recognize these trends, it is important to actively implement strategic controlling. It enables comprehensive evaluation and analysis in order to determine the effectiveness, efficiency and success of the project. As a result, the KPI system in project management represents an interplay of operational and strategic controlling KPIs based on both monetary and non-monetary indicators.

The main task of strategic controlling is to ensure the long-term efficiency of the project, its profitability and the reliability of forecasts for the investing company. Here, project goals and measures to achieve them are defined and a management information system is created to deal with these issues:

- Identification of the strengths and weaknesses of investment objects (SWOT analysis)

- Analysis of the competition and new markets

- Attracting and retaining customers

- Monitoring trends and new technologies

- Monitoring social, political, economic and environmental changes

In summary, the analysis of the project environment is the basis for strategic investment controlling and the basis for weighing up and critically assessing the above-mentioned questions for strategic project management. The most important types of analysis are briefly explained below. The strengths and weaknesses analysis, also known as the SWOT analysis, is a framework for evaluating opportunities and risks in the market on the part of the investment target. The potential analysis focuses on the economic development opportunities. A product life cycle analysis goes one step further and analyzes demand, the market environment and the "lifespan" of a product. The gap analysis, on the other hand, tracks the realization of strategic goals and compares them with the current business.

Project management

Milestone trend analysis, earned value analysis and project scorecards offer unique perspectives and methods for proactive project management.

- Milestone trend analysis tracks project progress by comparing planned milestones with actual progress. Trend lines in the diagram identify and illustrate possible delays at an early stage.

- Value added analysis (EVA): Evaluates project performance based on planned costs, actual costs and profit achieved. By comparing these values, deviations in costs and time can be determined. EVA enables comprehensive monitoring and accurate forecasts for the further course of the project.

- Project scorecard: A scorecard created based on critical success factors and specific project objectives.

Smooth communication in Ukrainian and in English, is extremely important. This is because it achieves a very high level of detail and prevents misunderstandings.

4. Why is a reasonable forecast of a stable return on investment so important for investors?

The answer to this question is simple, because it has a quantifiable impact on the investor's financial position and liquidity. First, we should assume that the asset acquired for further investment is engaged in an economic activity and generates income. Such an investment is associated with an economic benefit for the investor, which must be calculated correctly. Therefore, the central point in this phase is a reliable valuation and forecast of the expected cash flows (cash-in and cash-out): Cash-in - income from the economic activity; Cash-out - expenses for the acquisition, maintenance and upkeep of the investment object. The value of an investment is the discounted value (net present value) of the future cash flows expected to be derived from the asset or cash-generating unit. For this reason, cash flows from investing activities are the focus of both operational and strategic controlling. Unplanned, unbalanced expenditure (cash outflows) with unchanged income from economic activity reduce the cumulative economic value of an investment object. On the basis of controlling, measures can be taken to balance out cash flows.

A goodwill impairment event includes an increase in interest rates or changes in the socio-economic environment that affect the economy as a whole (coronavirus, war in Ukraine, etc.), as well as industry-specific changes (e.g. technological changes in certain industries that lead to an exodus of customers, etc.). The reference to the impairment of the investment property is relevant insofar as the ongoing war in Ukraine and a number of market and socio-economic uncertainties as well as rising credit interest rates, inflation, etc. cumulatively represent a significantly higher risk potential. If there is sufficient evidence that the value (profitability) of an asset has decreased, it is revalued. If the calculation shows that the discounted sum of expected returns (NPV = net present value) is significantly lower than the carrying amount of the asset, the difference is recognized as an impairment loss (write-down) and should be reported in the consolidated income statement and on the assets side of the investor's balance sheet.

5. Conclusion

The analysis of key performance indicators reveals optimization potential and supports the process of continuous improvement. However, this is not sufficient to bring the best projects to the Ukrainian market. There is much more involved and goes beyond the boundaries of project management, as there are various facets and areas to address that are relevant to the success of the project. Below is a comprehensive assessment with concrete steps.

- Evaluation of existing investment objects and opportunities. Selection of the best investment project.

- Structured and complete preparation of the project in cooperation with Ukrainian partners with the help of a proven but in detail individually adaptable project structure, which is based on the specifications of the development agency.

- Validation of existing projects regarding the viability of the investment project. Here, existing and potential risks and opportunities are scrutinized and weighed against each other. The identification of risks on the basis of early warning indicators makes it possible to recognize and address potential problems at an early stage. Assessing the ability of an investment object to generate sustainable returns is a key factor in deciding whether to invest in a project.

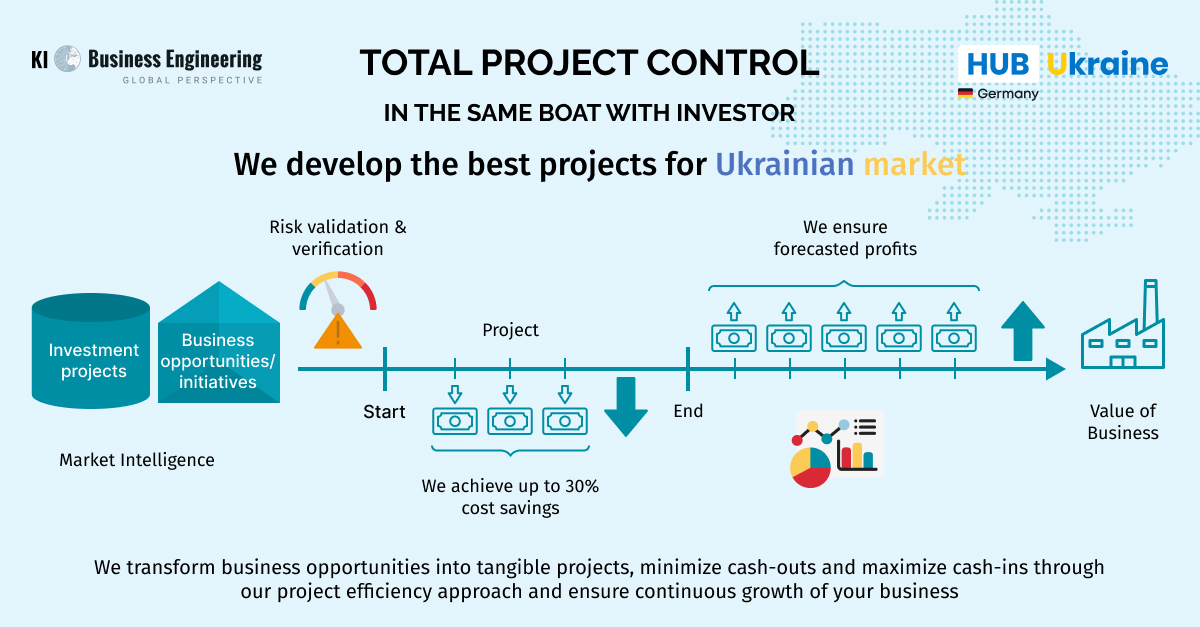

- Project cost planning. Project costs should be planned optimally and, and carefully controlled across two stages. In this way, manipulations in the use of funds can be minimized. Depending on the project, an optimization potential of up to 30% can be realized at this point.

- Control of project efficiency through KPIs: by means of 2-stage project cost controlling, constituted of operational and strategic controlling. Operational controlling is carried out by the local partner, while strategic controlling is carried out by KI Business Engineering or the investor themselves. Smooth communication takes place in Ukrainian, as well as in English. Intercultural peculiarities are herein accounted for, achieving a very high level of detail and preventing misunderstandings.

- Measures are implemented that aim to measure the success of the project and maximize income / profits from the investment. Increasing cumulative returns should increase the value of your business and this is the main goal towards which we will work.