This article explains:

- Business financing scheme in cooperation with partners from Germany

- Obtaining guarantees in case of financial losses when exporting to Ukraine

- Obtaining guarantees in case of financial losses in the course of investment activities in Ukraine

1. Business financing scheme in cooperation with partners from Germany

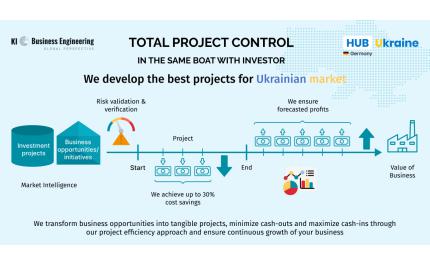

It is not easy to conduct economic activity in the Ukrainian market due to the ongoing hostilities and significant risks from investors or partners. German entrepreneurs are conservative when it comes to risks and investments. And this is quite understandable. As they jokingly say, German businessmen are used to having double insurance when expanding into foreign markets - figuratively speaking, wearing a belt and suspenders, especially in relation to markets with significant risks. We have developed the perfect combination for you, namely those suspenders to the belt that can convince German partners to invest and export to the Ukrainian market.

The goal is to create conditions for potential German partners to invest and develop business and investment projects in Ukraine that will be cost-effective and meet the requirements for export or investment guarantees, thereby reducing financial risks

Now we can see cooperation on the points I mentioned:

1. FILL OUT THE FORM FOR YOUR PROJECT

a) Business project (bi-engine.com)

b) Investment project (bi-engine.com)

c) Request form for cooperation with KI Business Engineering (bi-engine.com)

In points a) and b), please provide as much specific, detailed information about your business or investment project as possible. If you do not have any, please fill in point c), sharing your plans and goals that we can discuss with you

2. WE PROVIDE YOU WITH ACCESS TO INFORMATION THAT IS IMPORTANT FOR THE REALIZATION OF YOUR PROJECT.

The first and very important fact. Insurance, financial, credit and governmental organizations for business promotion in Germany or the development of German business abroad serve companies that conduct their economic activities in Germany. Unfortunately, all these resources and opportunities are not at your disposal, but they can be used by your potential partner. No matter how attractive the concept of developing your business in Ukraine may be, potential partners should know about it. Often at meetings, consortia, or specialized exhibitions of German entrepreneurs, offers are made: "contact us if you have an economically viable project to enter a foreign market." And this is exactly where economically sound, profit-oriented initiatives for the Ukrainian market are lacking. The reasons are:

- Asymmetry of access to information. Since KI Business Engineering is present at such events and is known to a large number of entrepreneurs, this problem will be solved for you, and you will have information about opportunities and offers from German partners and organizations.

- Lack of a clear detailed business plan with a pragmatic vision and reliable profitability indicators. A good presentation is unfortunately not enough.

3. WE CONDUCT A SWAT ANALYSIS AND DEVELOP A STRATEGY FOR ATTRACTING GERMAN INVESTORS AND PARTNERS FOR YOUR JOINT PROJECT

The scope and duration of this stage depends on the completeness of the information provided, the specifics and scope of the project. Coordinated cooperation with KI Business Engineering is a prerequisite for effective work.

4. PREPARATION, IMPLEMENTATION AND PRESENTATION OF YOUR PROJECT IN THE CIRCLES OF TARGET PARTNERS IN GERMANY.

Why is it important to follow this algorithm? Let's start with the fact that the partners are not aware of your project or have other worthy alternatives for development in other markets with lower risks. Based on this situation, they, German entrepreneurs or investors, should receive the most attractive and economically sound offer possible. This increases real interest. We know that the interest of German partners in your project will also grow if you have financial guarantees that will reduce the risks of business losses. Even a positive reaction of the partners to the economically sound proposal of your project does not mean specific business actions. More often than not, potential partners and investors are of the opinion that "we'll wait until better times" because there are no mechanisms for insuring financial risks and business losses. Don't forget, our goal is for the investor to have not only a belt but also suspenders, but so far we have only a belt as an economically viable and profitable project, and this is not enough. Therefore, we are moving on to the next point of our work related to cooperation in providing guarantees against business losses in the foreign market, which can be secured by German partners.

The work is carried out in several directions and depends on the type of business project

a) Export. Obtaining export guarantees from the German government to hedge against possible non-payment of receivables.

b) Investment activity. Obtaining investment guarantees from the German government to hedge, i.e. to cover possible investment losses.

c) Obtaining financing and loans, if necessary, for significant investment needs.

Summarizing our steps to date:

- your project is submitted in full for review,

- We have agreed to cooperate with you,

- we prepare and present your project to potential partners in Germany,

- found a partner, an investor,

- At this stage, we work to obtain guarantees from the German government (a) or (b). Once the guarantees are in place, and if necessary, we support the German partner in further attracting financing through credit institutions and other organizations (c).

2) Obtaining guarantees in case of financial losses when exporting to Ukraine

An exporter is constantly facing challenges, especially when it comes to entering markets, how reliable the customer is, and how to finance the business. It's good that there are insurance companies that support with expertise and appropriate insurance products to protect against risks and non-payments, but what happens if the economic and political risks are too great for the insurance company or the credit periods requested by the client are too long? What if there is no suitable offer? Then the solution may be state export credit guarantees - the so-called German Hermes Cover is an export credit guarantee issued by the Federal Republic of Germany, under which the risk of default is transferred to the state. This benefits the exporter and the financing bank by providing coverage provided by the federal government, which allows for projects that would not be possible without government support. Hermes coverage also makes it much easier to find a bank to finance a business. This allows banks to offer their clients attractive financing terms, an aspect that is becoming increasingly important in international competition. The size of the company plays as little role as the size of the order. German companies planning to export abroad can make a free and non-binding preliminary inquiry.

Goods and services that, among other things, serve to secure and create jobs in Germany and open up new markets are eligible for promotion. Small and medium-sized enterprises (SMEs) deserve special support.

The main criteria are:

- Creditworthiness of a foreign customer

- Country risk

- Creating value in Germany

- General contractual terms and conditions

- Payment terms and deadline

- Environmental, social and human rights standards

Of course, the fulfillment of the above criteria is a prerequisite and the main ones relate to the partner of the recipient country, in our case you, as a partner for doing business in Ukraine. If the customer makes an advance payment in Ukraine, the export guarantee is usually not applicable. If not, the question is how long the buyer will pay and whether the seller sees a risk that he wants to insure. Transactions from EUR 300 thousand with a payment term of up to 5 years will be covered. Amounts up to EUR 300 thousand may have phased payment terms over 1 year (< EUR 125 thousand) or 2 years (< EUR 250 thousand). However, the seller, i.e. the inter-German partner, also has an important say in this matter, because he has to overcome the time without money.

First of all, both parties have to agree on the product, delivery time, warranty, delivery conditions, etc. Our special framework condition is that we work all over Ukraine, except for 6 regions where there is a war.

The process of applying to Hermes is as follows:

- Preliminary request - free cursory preliminary study of the agreement

- The application is submitted online - here on the applicant's website you can find a cost calculator

- Waiting for a decision - from 14 days to 6 months depending on the size of the project

3) Obtaining guarantees in case of financial losses in the course of investment activities in Ukraine

Investment guarantees from the federal government. Many countries offer interesting opportunities for production and sales locations. It should be noted here that the Ukrainian market is in competition with other countries that may not be as politically stable as Germany, and this carries high risks. For example, military action, the threat of deprivation of rights or lack of access to justice, problems with foreign currency transfers, etc., can jeopardize investments. In such cases, the federal government's investment guarantees can be a solution. They offer German investors protection against unpredictable political risks. Thus, they retain control and security over each investment. All investments that merit support and are justified in terms of risk are covered by the guarantee. Projects that are expected to have a positive impact in both the host country (Ukraine) and Germany are eligible for funding. For example, through the development of expertise or the creation and retention of skilled jobs. In addition, the project must be harmless in terms of social and human rights issues. For example, investments that are protected from political risks by international treaties are justified in terms of risk. In this regard, the German government has concluded so-called investment promotion and protection treaties with many countries that do not offer sufficient legal protection under EU treaties or the legal system of the host country. Federal investment guarantees have a double effect. The federal government assures the company of political support throughout the project implementation period. If there is a threat of measures such as expropriation, the federal government supports the investor company in its relations with the host country government (Ukraine). In this way, it is often possible to prevent losses. If investments are lost due to political measures or war, the federal government compensates for the losses. This makes it possible to implement projects in difficult target markets that would not be possible without government support. Investment guarantees also have advantages when refinancing, as your investors and lenders also benefit from the guarantee protection.

The following investments can be covered:

- Participation in the project, company (Beteiligungen)

- capital equipment of branches or production facilities (target capital)

- equity-like loans from a shareholder or bank

- Other rights to assets (for example, from commodity service contracts or bonds).

The warranty protects against the following risks:

- Nationalization, expropriation or measures equivalent to them

- war, armed conflict, revolution and riots or terrorist acts related to such events

- violation of legally binding obligations by the state or state-controlled organizations

- Moratoriums on payments and restrictions on conversion or transfer of funds

How intensively are investment guarantees used?

In 2022, the federal government assumed investment guarantees totaling EUR 2.3 billion (2021: EUR 2.6 billion). Despite a slight decrease in the volume of new coverage, the number of approved applications increased significantly year-on-year to 43 (2021: 30). Of the applications approved in 2022, 47% were submitted by small and medium-sized enterprises, the highest number in recent years. This indicates that effective protection against political risks when entering foreign markets has become much more relevant for small and medium-sized enterprises.

The sharp increase in the number of inquiries also indicates a high level of interest in covering political risks. It is clear that German companies continue to invest heavily in developing and transition countries and that protection through investment guarantees is often an important prerequisite for investment decisions in view of the significant political risks involved, particularly in Ukraine.

Prerequisites for providing guarantees

In order for the German government to provide investment guarantees, it is also necessary to ensure that the host country, i.e. Ukraine, has sufficient legal protection for investments. This usually happens if Germany and the host country have an agreement on investment promotion and protection. Such cooperation exists. EUR 280 million of investment guarantees for 14 German companies in Ukraine with a total coverage (maximum liability) were approved in 2023.

Investment guarantees can only be provided for new investments. Therefore, an application for an investment guarantee must be submitted before the investment is realized.